Khoza - Pushing the ANC Over the Edge

Chairman of Nedbank [one of the top four banks in South Africa] Reuel Khoza boldly came out criticising the South African government on its leadership and direction challenging the country’s leaders in the Banks annual report, published at the end of March 2012, to lead with accountability.

“We have a duty to build and develop this nation and to call to book the putative leaders who, due to sheer incapacity cannot deal with the complexity of 21stcentury governance and leadership, cannot lead.” These are strong words indeed but the sentiments are certainly not new, but usually said behind closed doors and at the dinner table.

The Minister of Police, Nathi Mthethwa, government spokesperson Jimmy Manyi and [significantly] secretary general of the ANC, Gwede Mantashe, slammed Khoza. Mantashe even went as far as to accuse him of being disrespectful, warning that his comments might threaten foreign investment.

On the same footing, many have also defended Khoza and reiterated his views. We live in a democratic society, after all. Freedom of speech is enshrined in the Constitution. Such debates are necessary to put pressure on the government to be more accountable as demanded by citizens. Khoza should be admired for his courage.

But, as a communications professional, I also question his choice of platform. Annual reports are usually about the financial performance of organisations and their future prospects. The chairman’s review should stick with the economic challenges and point to opportunities for future business growth.

The merits of what Khoza stated aside, such controversial opinions belong in the opinion and analysis pages and public speaking forums – where they can be challenged and debated. That does not happen in annual reports.

Another question that needs asking is: is it worth the reputational risk, which, by the way, could affect a company’s profits – something that should be his duty to protect? The SA Democratic Teachers’ Union in Kwazulu-Natal has already called for government to shift all its accounts from Nedbank. Mantashe himself has already made this veiled threat. “We will not turn our back on Nedbank if they want to engage. An issue that must be discussed in earnest is whether banking with an institution that sees you as foolish and insane makes any sense.” (Sowetan, April 13).

Whatever the merits of Khoza’s opinion, business leaders need to strike a balance between gambling with shareholder funds and freedom of speech. My advice is to err on the side of shareholder value. That, after all, is their fiduciary duty.

Nedbank now faces a reputational issue [not crisis], which can be managed. I would recommend an olive branch, and discussion on how the banking industry could be given the opportunity to be part of the solutions to the problems which impact business in the country.

After all this is the subtext of Minister of Finance, Pravin Gordan, when he says there is a need for cooperation and “generosity and goodwill to sustain SA’s democratic vision.” (Business Day, April 17).

Find Out More

-

Digital Insights Bulletin - October 2024

October 31, 2024

-

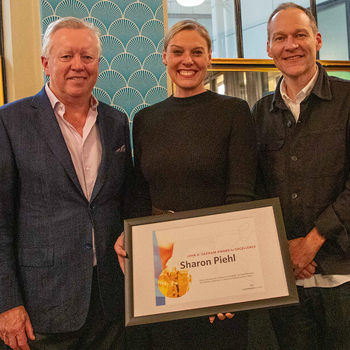

Sharon Piehl Wins 32nd Annual John D. Graham Award for Excellence

October 25, 2024

-

Digital Insights Bulletin - September 2024

September 30, 2024